Get upto 25%* Off on your Term Insurance

Term insurance, commonly known as term life insurance, provides excellent life coverage at affordable premium rates. A term plan provides financial protection to the policyholder's family in exchange for a fixed premium for a certain period of time, known as the policy 'term'. If the insured person dies within this time, the selected cover amount is given to the nominee as a death benefit.

- Term life insurance covers you for a specific amount of time at a specific premium cost.

- In the event of the life insured's untimely death during the policy term, the nominee receives the Total Payout/Benefit. The benefit might be given out as a lump amount, a mix of lump sum and monthly payments, or simply monthly payments.

- As a result, term insurance plans are defined as pure protection plans that safeguard the financial stability of dependents in the event of the premature death of the person insured.

The Advantages of Term Life Insurance

- Death Benefit: If the life insured dies during the policy period, the nominee will get the Total Payout as a lump sum or a mix of lump sum and monthly amount.

- A lump sum payment to cover immediate financial obligations.

- Monthly income to support the family's way of life.

- Tax Benefit: Premiums paid for term life insurance are tax-free up to Rs. 1, 50,000 under section 80(C).

- Rider Benefits: Riders are a significant complement to the standard plan provision since they allow the life insured to tailor the coverage.

- The Accidental Death Benefit rider provides an additional sum insured beyond the standard plan providing in the event of death caused by an accident.

- The Accidental Disability rider provides an immediate lump sum payout in the event of a disability caused by an accident.

- If the life insured is diagnosed with one of the serious diseases listed in the rider, the Critical Illness rider provides an extra sum assured beyond the basic plan provision.

- The Waiver of Premium rider waives all insurance premiums if the life insured is diagnosed with a permanent disability or a catastrophic disease.

- Option to raise death benefit: Certain policies provide an option for the life insured to enhance the life cover during critical life periods such as marriage and childbirth.

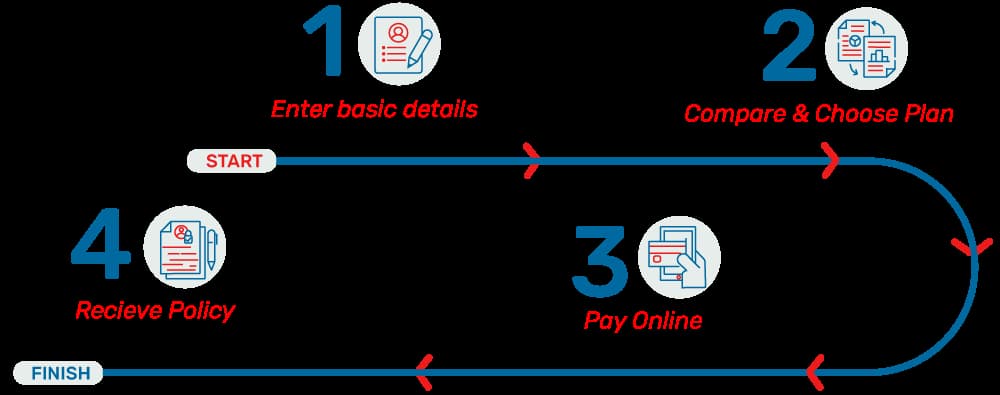

Buy Policy In just 4 easy steps

SIB is the best insurance broker in Gurgaon, Delhi NCR, India, specializing in providing one-of-a-kind insurance.