Get upto 80%* Off on your Two Wheeler Insurance

Two wheeler insurance/Bike Insurance is a policy purchased to protect your motorbike or scooter from damage caused by an accident, theft, or natural catastrophe. Two-wheeler insurance protects you against third-party liability resulting from injury to one or more people. Bike insurance is an excellent way to cover the financial costs and losses that may come as a result of motorbike damage. The bike insurance policy protects all forms of two-wheelers, including motorcycles, mopeds, scootys, and scooters.

Two-wheeler insurance typically covers the vehicle against various risks such as accidental damage, theft, fire, and third-party liabilities. The third-party liability coverage is mandatory in most countries and covers the damage caused to other vehicles or people in case of an accident involving the insured vehicle.

Two-wheeler insurance policies come in two types - third-party liability only policy and comprehensive policy. A third-party liability policy covers only the damages caused to the third-party in case of an accident involving the insured vehicle. A comprehensive policy, on the other hand, provides coverage for damages caused to the insured vehicle as well as third-party liabilities.

Different Types of Two Wheeler Insurance Policy in India

Types Of Two Wheeler Insurance Policies in India

When you ride a bike on a public road, you essentially put other people and yourself at risk for mishaps, collisions, etc. These occurrences could be the result of carelessness or lack of experience. In either scenario, the bike may sustain full or partial damage, while the other drivers may sustain injuries or even pass away. Bike insurance is a need in order to protect against such tragic occurrences.

What are the types of two-wheeler insurance in India?

There are three primary types of bike insurance plans in India:

- Comprehensive Two-wheeler Insurance: As the name implies, this policy provides comprehensive 360-degree protection for both you and your bike against any third-party liability. A comprehensive bike insurance is a sort of two-wheeler insurance that provides the owner-driver with personal accident coverage as well as coverage for any legal and financial third-party obligations as well as own-damage coverage for the covered bike. Additionally, by supplying a list of special add-ons with your policy, you can acquire customised coverage against particular situations. Zero Depreciation Cover, Roadside Assistance Cover, and other add-ons are popular choices.

- Third Party Bike Insurance: According to India's Motor Vehicles Act, a bike must be insured to cover any liabilities that may result from losses or damages incurred by third parties as a result of collisions caused by the insured bike. Third-party bike insurance is the common name for this type of insurance plan for bicycles. If the insured bike causes an accident within the terms of this policy, any injuries to or fatalities of third parties, as well as damage to their vehicles, will be covered.

- Standalone Own Damage Cover: The damages brought on to the insured two-wheeler are covered by a stand-alone own damage two-wheeler insurance policy, a form of bike insurance policy. It covers losses brought on by both natural and man-made disasters, bike theft, and complete bike destruction (damaged beyond any repairs). However, the liability of third parties is not covered by this policy. This policy is therefore only available when purchased with the legally required third-party liability coverage.

To accommodate their customers' various needs, insurance companies in India today provide a variety of insurance policies. If you want to purchase insurance for your two-wheeled vehicle, you should evaluate the inclusions and limitations of the policies offered by various insurance providers.

5 Advantages of Two Wheeler Insurance

Buying two Wheeler insurance is imperative for financial protection and security during crises caused by accidents. If you can claim compensation for damages, recovering from unexpected occurrences becomes a lot easier.

- Third-party liability coverage: Purchasing two-wheeler insurance is required by The Motor Vehicles Act of 1988 because it guards you against third-party liability resulting from personal injury or property damage you may cause while operating your insured motorcycle. With insurance coverage, the insurer will compensate the third party and take care of any potential legal liabilities that may result from such situations.

- Comprehensive protection: You can opt to purchase a third-party liability policy, which exclusively compensates for third-party damages and resolves any related legal matters. However, you must choose a Comprehensive Two-Wheeler Insurance Policy if you want the insurance coverage to pay for damages to both you and the third party. Its coverage of both natural and man-made disasters is quite thorough. By paying a little higher premium, you can choose add-ons in addition to the basic coverage. These include, to name just a few, NCB Protect, Pillion Rider, Two-Wheeler Insurance Personal Accident Cover, and Zero Depreciation.

- No Claim Bonus/Discount: If you haven't filed a claim in any policy year, you'll get a sizable discount on the premium due when your policy is renewed. This is the premium being reduced by the No Claim Bonus. The reductions keep getting better with each claim-free renewal that goes by.

- Zero penalties: You can determine which company offers the best rate for the coverage it offers by comparing auto insurance quotes from several suppliers. Avoiding this step and selecting the least expensive plan may result in lower annual premium costs. However, if you file an accidental claim, you can be required to pay a sizable voluntary deductible. Therefore, before accepting the terms and conditions, you should be fully aware of the policy coverage.

- Stress free, life saver Insurance offers two advantages. a release from tension and potential risk. If you get insurance, you can be certain of having financial security and mental tranquilly because you are acting responsibly and morally. When you purchase insurance and renew it on time, you protect both yourself and your two-wheeler from unanticipated occurrences.

Insurance offers two advantages. a release from tension and potential risk. If you get insurance, you can be certain of having financial security and mental tranquilly because you are acting responsibly and morally. When you purchase insurance and renew it on time, you protect both yourself and your two-wheeler from unanticipated occurrences.

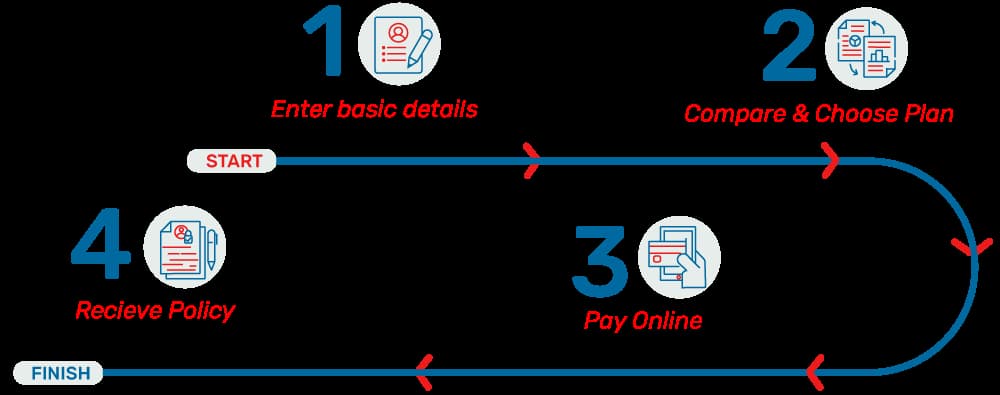

Buy Policy In just 4 easy steps

SIB is the best insurance broker in Gurgaon, Delhi NCR, India, specializing in providing one-of-a-kind insurance.