Get upto 80%* Off on your Car Insurance

Car insurance is a type of insurance policy that protects car owners financially in case of accidents, theft, or other types of damage to their vehicle. It is a legal requirement in most countries for drivers to have at least basic car insurance coverage.

Car insurance provides assurance from insurance providers that your investment in the car is secure if you are involved in an accident or the vehicle is stolen, destroyed, or vandalised for a number of reasons. Instead of paying out of pocket, the car insurance provider covers for damage expenses in exchange for a set yearly payment.

The coverage and cost of car insurance policies can vary depending on several factors such as the type of vehicle, the driver’s age and driving record, and the level of coverage required. In general, car insurance policies offer different levels of coverage including liability coverage, collision coverage, and comprehensive coverage.

Liability coverage is the minimum coverage required by law and is designed to protect drivers from financial responsibility in case they are at fault in an accident. This type of coverage pays for damages to the other driver’s vehicle, as well as any medical expenses they may incur as a result of the accident.

Different Types of Car Insurance Policy in India

How can car insurance help you in future?

When you buy a car, it is necessary that you buy car insurance as well. The Motor Vehicles Act, 1988, mandates this due to the following reasons: It reduces your liability - Buying third-party motor insurance is lawfully necessitated for all vehicle owners in India.

You are financially protected from high medical expenses by a car insurance policy. It pays for all medical costs, letting you concentrate on a quick recovery rather than stressing about money.

Yes, practically all states require drivers to have auto insurance. Drivers in New Hampshire are not required to get auto insurance, but they are required to provide documentation demonstrating their ability to cover the costs of an accident if it is their responsibility. Because it is required by law, most motorists have auto insurance, but this does not mean that you should only get the bare minimum of protection. Buying auto insurance has many benefits.

Car insurance can help protect you and your family from huge expenses. By investing a small amount now in your own protection, you can help avoid costly expenses in the future. Coverage such as collision insurance, comprehensive insurance, property damage liability and bodily injury liability can help cover the costs of expensive claims if an accident happens.

Different Types of Car Insurance Policy in India

Car insurance is the safety net for your car by providing damage protection to your car and your lives. Car insurance covers repairing any minor to major damage and covers anything that happens to your car due to fire, any natural hazards or accidents. The insurance can help you to cover all the damages.

Cover loss and damage

Your car is protected from an accident, a fire, or self-ignition. Your insurance policy also covers losses if the car is damaged by terrorism, strikes, rioting, or burglary. Car insurance also protects against loss or damage while being transported by rail, inland waterways, air, road, or lift.

Cover personal accident

Protection against accidental death & permanent complete disability is offered by personal accident insurance. Also this car insurance covers loss for other passengers on unnamed basis which depends on the capacity of people inside the car.

Big number of garages

Some companies which provide car insurance maintain a large network which provides you cashless service and you can use any locations. This feature makes it convenient to avail of repair services in case of any damage to your vehicle.

Third party liabilities

if your car is insured then even if it involved in an accident that causes loss or damage to the property of any third parties. Additionally, the car insurance shields you from any liabilities you could suffer in the event of a third party's death or physical injury.

No claim bonus

The no claim bonus (NCB) is a major benefit of having car insurance The customer is qualified for this benefit for each year without a claim. This might be offered as a discount on the rate, which would further lower the cost of car insurance.

Natural Disaster

our car is protected from an accident, a fire, or self-ignition. Your insurance policy also covers losses if the car is damaged by terrorism, strikes, rioting, or burglary. Car insurance also protects against loss or damage while being transported by rail, inland waterways, air, road, or lift.

Difference between third party & comprehensive policy

It's crucial to understand the distinction between comprehensive and third party auto insurance before you purchase coverage. When you drive on the roads, insurance for your car is a must for protection. Insurance acts as a safety net to cover the costs of repairing your car and getting it back on the road after an unfortunate accident, whether it was your fault or the fault of a third party.

| Third party car insurance policy | Comprehensive car insurance policy |

|---|---|

| A third party car insurance policy only covers risk related to damages caused to a third person or vehicles | Comprehensive Car Insurance offers extensive coverage that covers Third-party Liabilities and Own Damage. |

| As per The Motor Vehicles Act, third-party car insurance is mandatory while driving a vehicle in India. | Buying this type of policy is not mandatory by law |

| Third-party Car Insurance is the most basic and compulsory insurance plan for your car. | Compressive car insurance has enhanced coverage, so it is the preferred choice for many car owners. |

| It provides financial and legal assistance if you injure a third party or damage their vehicle/property. | Comprehensive Car Insurance is a policy that covers third-party liabilities and damages to your vehicle arising from accidents, natural calamities (floods, cyclones, etc.), manmade calamities (riots, vandalism, etc.), and fire. |

| You don’t need to have comprehensive insurance to have a third party insurance | You need to have a third party insurance in order to have a comprehensive car insurance. |

| In third party insurance you cannot buy add-ons. | You can even buy add-on covers to increase your coverage. |

| The cost of a Third-Party Car Insurance Policy is fixed by the Insurance Regulatory and Development Authority of India (IRDAI) based on the car engine’s cubic capacity. | The cost of this policy is fixed by the insurer as per the terms and conditions of the policy. |

What are the factors affecting car insurance premium?

Auto insurance is required. This does not imply that each time you insure your car, you must spend a fortune! Right, a penny earned is a penny saved? If you are aware of the variables influencing auto insurance, you may be able to make things work in your favor.

When you decide to purchase or renew auto insurance, the insurance premium is a crucial consideration. Unquestionably, it's crucial to purchase a cheap coverage, but it shouldn't leave you underinsured. When an unpleasant incident involving the insured car occurs, you could find yourself in the midst of a financial crisis if you have inadequate insurance.

- Make, Model, and Variant: An expensive sedan will have a higher insurance cost than a hatchback. This is due to the vehicle's fundamental design. Because of this, the manufacturer, model, engine size, etc. of your car will all directly affect the cost of your auto insurance.

- Age: The age of the vehicle considers Insured Declared Value and Depreciation, two crucial auto insurance concepts (IDV). These two ideas are related to one another. Depreciation is the decrease in asset value brought on by normal wear and tear over time.

- Location: Car insurance in a metro area will be more expensive than in a tier 3 city. This is due to the perception that the car is vulnerable to harm in an urban environment. For instance, in a city like Mumbai, accidents commonly occur due to factors like rising traffic, congested roadways, etc.

- Cover: Basic Third-party policy is mandatory in India. It offers cover against third-party liabilities. On the other hand, a comprehensive car insurance policy covers Own Damage along with third-party liabilities. Plus, you can enhance the coverage with the help of Add-ons.

- No Claim Bonus (NCB): Insurance companies offer a discount on the premium (on car insurance renewal) if you haven’t raised a claim during the previous policy period. Do not be in a rush to raise a claim.

- Anti-theft Device: You may be able to lower your auto insurance premiums by securing your vehicle with an anti-theft device that has been approved by the Automotive Research Association of India (ARAI).

- Deductibles: If you want to lower the cost of your insurance, you can choose a voluntary deductible. In essence, this means that you will make a fixed contribution to the claim amount. As a result, the insurance provider can lower rates by having to spend less to resolve claims.

- Seller: Think and analyses before you buy the car insurance. If you buy car insurance via a broker, the broker is required to make a commission for their services. It's possible that if you buy it from a car dealer, the dealer may give you a fixed insurance with coverage you might not desire.

- Digital Insurance: Digital-first insurers provide affordable Comprehensive car insurance coverage with enticing features. They can sell policies at a lower price than the market because they incur fewer operational costs. Before buying a policy or while renewing your auto insurance, be sure to compare rates on the websites of online insurers.

Why Should You Compare Car Insurance Online?

You should consider buying auto insurance at the same time that you consider purchasing a vehicle. The only legal method to secure your precious item is with automobile insurance.

Nowadays, buying new car or commercial vehicle insurance, as well as renewing an existing policy, is simple thanks to the development of online services provided by insurance providers. You must compare auto insurance plans because there are so many possibilities.

You should be aware of your insurance requirements and have a basic comprehension of the plans provided by various insurance companies. Comparing policies from several insurance providers is one of the most crucial things to do when purchasing auto insurance.

Some of the benefits from comparing car insurance online.

- You can determine which company offers the best rate for the coverage it offers by comparing auto insurance quotes from several suppliers. Avoiding this step and selecting the least expensive plan may result in lower annual premium costs. However, if you file an accidental claim, you can be required to pay a sizable voluntary deductible. Therefore, before accepting the terms and conditions, you should be fully aware of the policy coverage.

- Better understanding of the coverage providing by different plans under different insurance company.

- By comparing car insurance policy You can purchase the insurance that best meets your needs. For instance, only a small number of auto insurance plans include CNG fuel kits. You should purchase a policy that covers CNG if your car has it. You can make an informed purchase decision by understanding the features of various insurance policies through online comparison.

- Regardless of the kind of insurance coverage you choose, you must carefully read the policy documents. The policies have a number of inclusions and exclusions that may influence your purchasing choice. Without a thorough grasp of the policy, particularly the exclusions, you risk getting an insurance that does not match your needs. You can find products that provide the coverage you need by comparing four-wheeler insurance online.

- You should also do a research on add on while comparing the car insurance also.

All purchasers of auto insurance policies must, without fail, compare automobile insurance rates online. Prior to making your final choice, comparing insurance enables you to assess a variety of plans, the majority of which you would have otherwise overlooked.

According to the variety of automobile insurance plans and the level of coverage they provide, insurance premiums normally vary. Typically, a no-frills policy—one without additional covers or extra features—is the least expensive.

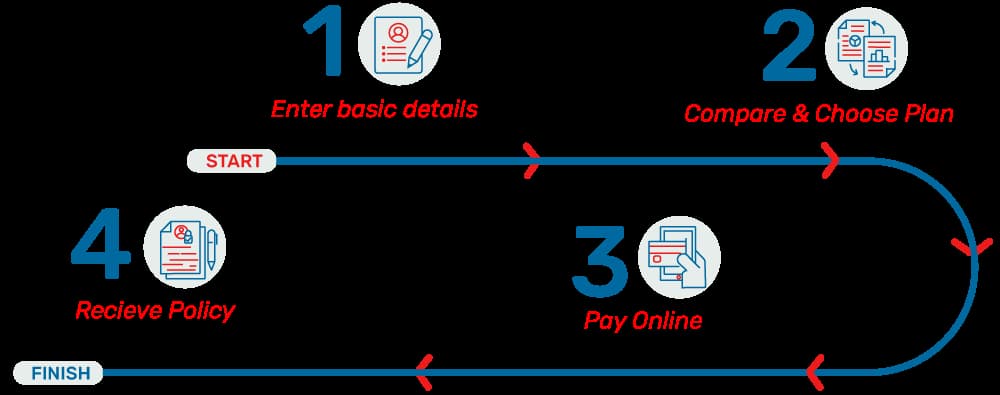

Buy Policy In just 4 easy steps

SIB is the best insurance broker in Gurgaon, Delhi NCR, India, specializing in providing one-of-a-kind insurance.